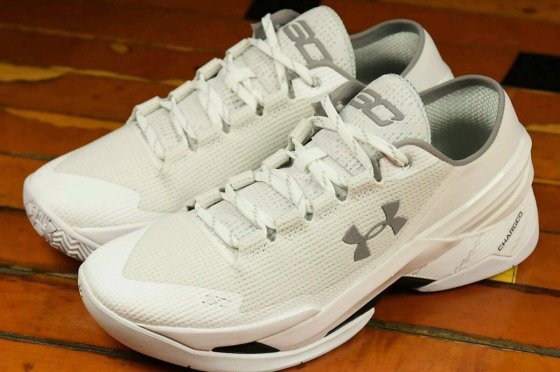

Under Armour Announces New UAS Line

Under Armour launches their newest initiative, UAS or Under Armour Sportswear September 15, at New York Fashion Week for immediate sale at Barney’s, Mr. Porter, their own brick and mortar stores and a dedicated UAS website. This upscale, fashion sportswear product is anything, but performance athletic apparel. The athletic-inspired clothing is targeting “ambitious Millennials” with “modern American sportswear, at home in a professional work place and not on the field.

Photo credit Under Armour

Why UAS Makes Sense for Under Armour

Some people may be scratching their heads over this move into sportswear, but it makes perfect sense for a several reasons.

In 1997, Under Armour was a pioneer that introduced expensive, fashion performance apparel to a market used to activewear as thoughtless, cheap basics from footwear companies. They were the first major aspirational athletic brand for men, as Lululemon was for women.

Under Armour created an athletic brand that sold strength, prowess and status in the mind of the wearer and by the way, sold comfortable, performance apparel. Fashion branding is about stirring emotion and they have been squarely in the fashion business, since the beginning. They upped the ante on the whole men’s athletic market.

Under Armour is an epic brand, at a time when it is getting harder to achieve mega-status in a niche-driven, individualist market. The appeal of their brand gives them license to branch out into other categories and price points, upscale, technically-inspired sportswear being one.

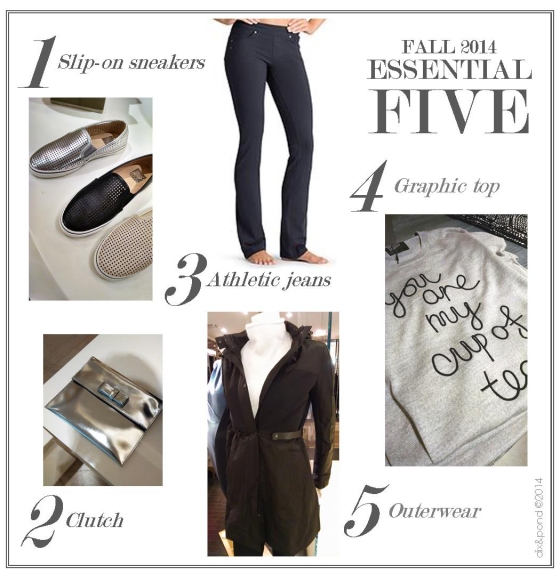

Consumers started wearing the higher quality, more stylish and comfortable clothing out of the gym. The use of performance fabrics and athletic details in everyday sportswear has been gaining steam for a while, as a natural extension of this trend.

The market is overflowing with spandex blended fabrics, polyester is no longer considered “low-rent”, performance properties abound and even merino wool has been “recast” as a technical fabric. Apparel startups Kit and Ace (former Lululemon founders) and Ministry (former MIT students) are two examples of this major trend. The new Van Heusen Flex Collection is selling comfort and technical properties to the men’s moderate wear-to-work market.

Sportswear is being inspired by athletic apparel and is experiencing a huge disruptive change to the look, feel and function of these categories.

Photo credit Under Armour

The Athletic Apparel Market Is Extremely Competitive

For more than a decade now athletic apparel has been the big growth story in a lack-luster apparel industry. Athletic startups and existing brand extensions have exploded. There is much less breathing room in the active market right now. Either you innovate, take risks, extend your brand in new categories or stagnate, shrink or die. Puma, Adidas and Nike are all responding to this market shift with collaborations and extensions.

This market explosion has blurred the lines of distribution away from sporting goods to all retail channels, not good news for apparel-dominated sporting goods stores.

Under Armour was born from apparel lineage, so it is an easier transition for them. Many strong athletic footwear or sporting goods brands have yet to even capitalize on the seismic shift that happened in active lifestyle apparel. They are missing a great opportunity and do this at their peril. UAS has now gone beyond athleisure to sportswear.

UAS won’t be Under Armour’s biggest initiative simply because of price points, certainly not the huge opportunity of their new moderate distribution to stores like Kohl’s; but it will allow them to capture the imaginations and wallets of new customers.

Some other posts you might enjoy:

Decoding Millennial Shopping Traits & Habits

Are Sporting Goods & Outdoor in a Death Spiral?

7 Common Fashion Brand Management Mistakes

The Dix & Pond Blog, by Stephanie Bernier is the blog of Dix & Pond Consulting, a Boston-based, company that consults on business strategy, creative direction, brand experience, trends, product development and merchandising. Clients include retailers, apparel, footwear & consumer companies. CONTACT US TODAY!

Thank you for sharing with a friend, if you enjoyed the post!